- Safaricom has launched subscriptions for the first KSh 15 billion tranche of its KSh 40 billion Medium–Term Note Programme

- Applications can be submitted via USSD, the online portal, or by completing physical forms through authorised agents

- The bidding period closes on December 5, 2025, and the allotment results will be released on December 9 before the listing on the Nairobi Securities Exchange on December 16

Elijah Ntongai, an editor at TUKO.co.ke, has over four years of financial, business, and technology research and reporting experience, providing insights into Kenyan, African, and global trends.

Safaricom is in the process of issuing a corporate bond to finance its expansion in Kenya and Ethiopia.

Source: UGC

The company received approval to raise KSh 40 billion in financing through a Medium-Term Note Programme.

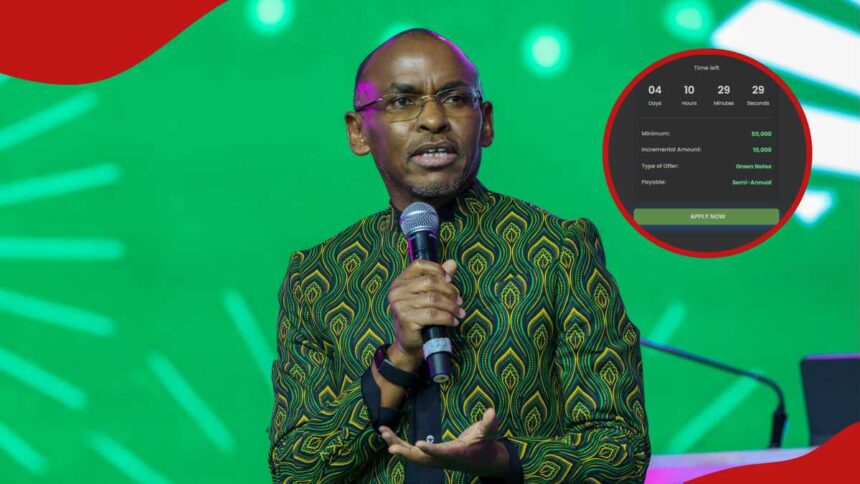

Safaricom has opened subscriptions for its first tranche of the Medium-Term Note Programme and invited Kenyans to invest.

The telco is seeking KSh 15 billion from the first tranche of fixed-rate green notes, and it is offering investors a tax-exempt annual return of 10.4%.

“We plan to raise up to KES 40 billion through the Safaricom Domestic Medium Term Note. The first phase is for KSh 15 billion, with an option to accept an additional KSh 5 billion if there’s extra demand,” Safaricom stated.

Notably, interest income accrued from the green notes will not be subject to tax.

The bond has a five-year tenor and whill mature on December 11, 2030, while the interest income will be paid to the investors bi-annually, on December 11 and June 11 in each year.

Read also

Safaricom invites Kenyans, others to invest in its KSh 15 billion notes with tax-free returns

How to invest in Safaricom’s green notes

Retail and institutional investors require a minimum of KSh 50,000 to purchase the bonds.

Notably, all investors need to have an active Central Depository and Settlement Corporation (CDSC) account to participate in the capital markets, including the Safaricom bonds.

Interested investors can participate through three channels:

1. USSD *483*810#

Safaricom instructed that to participate in the offer using the USSD,

- Ensure you have a Valid CDSC Account andsufficient balance on your Mobile Money to facilitate payment

- Dial the code (*483*810#) and choose Read the Terms and Conditions of the Offer, which you should read and understand before the next step.

- Agree to terms, then choose the “New Application” option, and thereafter follow the prompts to complete the process.

- You will receive a prompt to pay and later an email and/or SMS confirming the status of your application.

2. Online portal

To participate using the online portal,

If you had made an application before you can enter the details requested to add another application or click New Application for a fresh application.

Source: UGC

- Once you have duly completed and submitted the Application Form, you will be required to make payment and upload proof of payment documents (EFT or Bank Transfers).

This will be verified by the Data Processing Agent.

“Please look out for updates on the status of your application, which will be sent to your registered email address or through text message to the mobile number you indicated in the electronic application.”

3. Physical forms

Investors can also submit a physical form by downloading a serialised copy or obtaining one from authorised accepting agents or image registrars, then completing it as instructed and returning the filled application together with all required supporting documents to any of the placing agents.

Interested investors can access more details on the pricing, fiscal agents, and other supplementary details on the ‘Pricing Supplement’ document provided by Safaricom.

As reported earlier on TUKO.co.ke, the bidding period closes on December 5, and the allotment results will be released on December 9, informing those with successful bids.

The bonds will be listed for trading at the Nairobi Securities Exchange (NSE) on December 16.

Source: TUKO.co.ke