- President William Ruto’s administration continues to implement the NSSF Act of 2013, which increased mandatory contributions in phases

- Due to increased rates, the Retirement Benefits Authority (RBA) projects that the contributions will surpass KSh 100 billion in 2026

- Employers will continue matching the contributions made by employees, which has increased the cost of doing business for local firms

TUKO.co.ke journalist Japhet Ruto has over eight years of experience in financial, business, and technology reporting, offering insights into Kenyan and global economic trends.

From February 2026, Kenyan workers will pay up to an additional KSh 2,160 to the National Social Security Fund (NSSF), indicating weakening purchasing power.

Source: Twitter

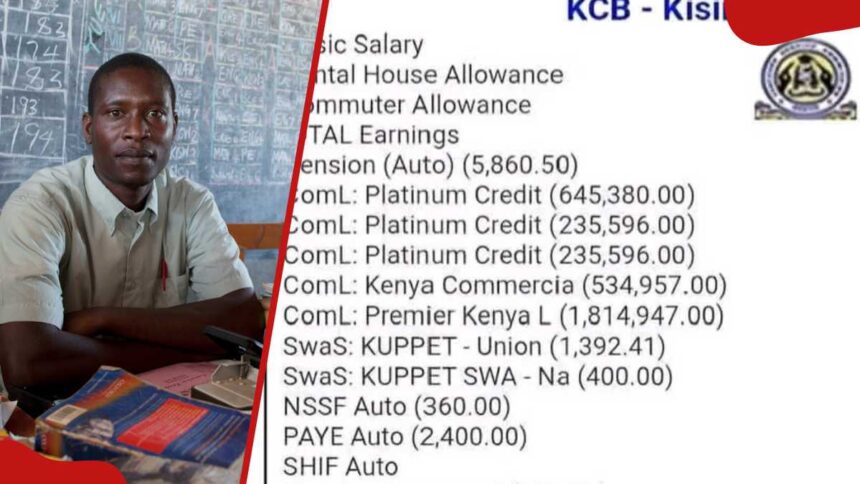

The New Year 2026 will mark the fourth year of an increase in mandatory deductions to the payslips, which have since risen from KSh 200 in 2022 to KSh 4,320 in 2025.

This comes even as workers’ salaries continue to stagnate amid the high cost of living.

Search option is now available at TUKO! Feel free to search the content on topics/people you enjoy reading about in the top right corner 😉

How much will Kenyans pay to NSSF?

Employees earning over KSh 100,000 will see their contributions increase from KSh 4,320 to KSh 6,489 per month.

However, workers earning less than KSh 50,000 will not be affected in the fourth phase of the implementation of the new higher NSSF rates.

The Retirement Benefits Authority (RBA) noted that the yearly contributions to the fund rose from KSh 19.29 billion in June 2022 to KSh 83.97 billion in June 2023.

It is expected that the contributions will surpass the KSh 100 billion mark in 2026 due to higher rates.

“Contributions to NSSF have been on steady growth over the last three years. The increase in contributions is attributed to the continued implementation of the NSSF Act 2013,” RBA stated, as reported by Business Daily.

Employers will continue matching the contributions made by employees, which has increased the cost of doing business for local firms.

Why did William Ruto raise NSSF rates?

According to President William Ruto, the move to raise the amount was intended to match one’s earnings rather than the standard payment.

Source: Twitter

state

The head of state described the previous KSh 200 amount as a “joke” and stated that these increased rates would enhance a better savings culture.

Central Organisation of Trade Unions (COTU) Kenya secretary-general Francis Atwoli Kali to raise the rates.

Atwoli argued that the KSh 200, which was raised tenfold in the first phase, was meant to ensure employees had better savings.

The SG said the union supports extending social protection to include areas such as the Jua Kali (informal sector).

What does the NSSF Act state?

Section 18 (1) of the NSSF Act 2013 states that the Pension Fund and Provident Fund are part of the scheme.

According to Section 18(4), everyone who is over the age of 18 and covered by the Employment Act of 2007 must be a member of the Pension Fund.

The monthly payment was increased from KSh 160 to KSh 200 when the NSSF statute was last reviewed in 2001.

The NSSF Act No. 45 of 2013 was created in 2013 as a result of the second amendment.

Employees making less than KSh 18,000 began making monthly contributions of KSh 720 in February 2023.

Source: TUKO.co.ke