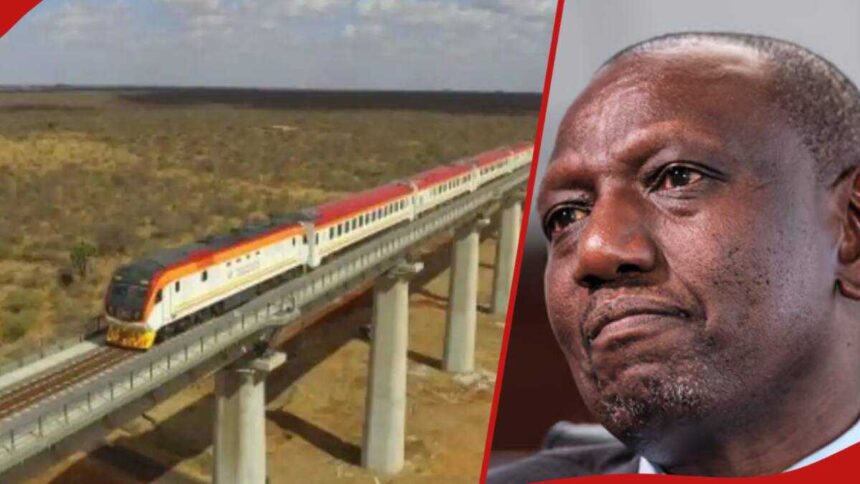

- President William Ruto’s administration was relieved after securing new repayment terms for the Chinese SGR loans

- Kenya was supposed to pay China Exim Bank the principal and interest on the SGR loans by 2035, but this was extended

- As part of the new terms, three dollar-denominated loans were converted into yuan, saving the country billions of shillings

TUKO.co.ke journalist Japhet Ruto has over eight years of experience in financial, business, and technology reporting, offering insights into Kenyan and global economic trends.

Kenya has extended the tenure of the three Chinese loans used to build the Standard Gauge Railway (SGR) to 2040, to alleviate the burdensome quarterly payments.

Source: Facebook

According to the Treasury, it negotiated revised conditions that made the loans a 15-year facility starting this year, along with a new five-year grace period during which Kenya will not be required to repay the principal amount.

The three dollar-denominated loans were converted into yuan as part of the extension, which is said to have saved the nation roughly $215 million (KSh 27.7 billion) annually.

Kenya was supposed to pay China Exim Bank the principal and interest on the SGR loans by 2035.

“The loans are now going to be paid for 11 years with a four-year grace period for a total of 15 years,” Treasury Cabinet Secretary John Mbadi announced, as reported by Business Daily.

How much did Kenya borrow from China for SGR?

Kenya borrowed $5.08 billion (KSh 655 billion) from the China Export-Import Bank in the financial year ending in June 2015 to construct the SGR from Mombasa to Nairobi and thereafter to Naivasha.

The SGR loans were originally scheduled to mature between January 2029 and July 2035, and the nation has been making interest payments on them twice a year in January and July.

During a time when public debt servicing costs account for more than half of government revenue, the expansion of the loan tenure and the grace period will make repayment of the SGR loans manageable.

Source: Facebook

The National Treasury now projects that servicing the SGR loans will only cost KSh 37 billion annually, compared to its previous projection of KSh 50 billion.

Why did Kenyan convert repayment from US dollars to Chinese yuan?

Kenyan officials attribute the currency swap, aside from the financial relief, to the concentration of the nation’s debt in dollars, which exposes the government to greater interest rate and currency risks.

Multilateral lenders were concerned that Nairobi was using their dollar loans to pay China instead of investing in the country’s infrastructure and budget, according to David Ndii, President William Ruto’s economic adviser.

According to official data, at the end of September, roughly 52% of Kenya’s external debt was in dollars.

Approximately 27.9% of the debt was in euros, 12.3% in yuan, 5.2% in yen, and 2.5% in British pounds.

Kenya wants to reduce its total debt, which is over KSh 12 trillion, or about 70% of its GDP, to make repayments easier.

In the 2025/2026 fiscal year, Kenya set aside KSh 129.9 billion to repay loans obtained from Beijing.

Source: TUKO.co.ke