For many new Kenyan traders, choosing a broker feels like a simple first step—a formality before the “real” journey begins. But in practice, this decision becomes a big determinant of whether a trader grows, survives, or quits.

The wrong broker doesn’t just affect spreads or execution. It affects confidence, psychology, and long-term progress. It shapes whether a trader sees markets as a place of opportunity or a minefield stacked against them.

And across Kenya’s growing trading community, the consequences of making poor choices are becoming increasingly visible.

The hidden risks tied to the wrong broker

The challenges of choosing the wrong broker rarely appear dramatically. Instead, they tend to manifest as a series of small inconsistencies that slowly affect performance.

Many Kenyan traders describe similar patterns: withdrawals taking longer than expected, spreads behaving unpredictably during busy market hours, or trades filling at slightly different prices than anticipated.

None of these incidents feel catastrophic in isolation. However, over time, they create uncertainty, and uncertainty erodes both confidence and discipline.

The real cost, however, isn’t just financial; it’s psychological. Traders begin to doubt their strategies when the issue is often their trading environment.

For example, a platform freezing during high-impact news doesn’t just affect a single trade; it disrupts a trader’s ability to trust their execution. A broker with unclear margin rules doesn’t just trigger earlier stop outs, it makes risk management difficult to measure.

Over months, these small gaps accumulate into lost opportunities, inconsistent results, and frustration that pushes many traders to step away altogether.

What a reliable broker actually looks like

Reliability is often misunderstood as a “nice-to-have,” when it is actually one of the most essential and practical trading advantages. A reliable broker offers stability during volatility, predictable pricing, and transparent processes that allow traders to focus exclusively on their strategy.

This is why traders across Kenya and Sub-Saharan Africa are gravitating toward brokers whose infrastructure is engineered for consistency.

One such broker is Exness, a company widely recognized for offering the tightest and most stable spreads on key instruments such as gold and oil,1 as well as consistently stable spreads on major currency pairs.2

Precise execution,3 even during high-impact news, gives traders a clearer alignment between their analysis and the price at which they enter the market. Fast execution coupled with instant and automated withdrawals4 ensures that traders maintain control over their capital at all times, reducing stress and allowing for more disciplined decision-making.

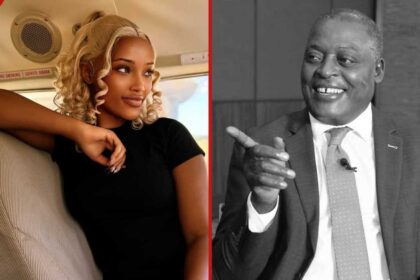

As Terence Hove, senior financial markets strategist at Exness, explains,

“Trust in a broker doesn’t come from promotions; it comes from consistency. When traders know that spreads behave predictably and execution remains stable, it becomes much easier to build long-term strategies and stay committed to them.”

These qualities form the foundation that strategy-driven traders depend on.

A trading environment shaped for long-term success

Kenyan traders are becoming increasingly analytical, community-driven, and performance-focused. They are comparing data, testing strategies, and becoming more intentional about how they manage risk. This shift has raised expectations; traders want brokers that match the sophistication of their approach, and the benefits are clear:

- A stable environment leads to more consistent decision-making.

- Predictable spreads allow traders to calculate costs accurately.

- Precise execution ensures strategies behave as intended.

- Clear withdrawal processes offer peace of mind.

- Transparent terms build long-term trust.

When these fundamentals are in place, traders are free to develop routines, refine their edge, and grow sustainably.

Why regulation matters in Kenya’s market

The Capital Markets Authority (CMA) has made significant progress in educating traders about the importance of regulated brokers. Under a regulated framework, client funds are protected, pricing practices are transparent, and traders have a clear point of recourse in the event of disputes.

This matters even more in Kenya, where unregulated offshore brokers still attract traders with aggressive marketing but offer limited accountability. Without regulatory oversight, traders may face unclear withdrawal processes, inconsistent execution practices, and customer service that disappears when it matters most.

A CMA-regulated environment doesn’t eliminate trading risk, but it ensures that traders are operating within a framework built on transparency and accountability.

Most traders don’t quit because trading is “too hard.” They quit because they never had a stable environment that allowed their strategy to work. In Kenya’s increasingly advanced trading landscape, the real advantage is no longer finding the “perfect” setup but choosing a broker that supports performance rather than undermining it.

The lesson is straightforward: A reliable broker doesn’t remove risk, but it removes unnecessary uncertainty.

And for traders building long-term success, that difference is everything.

1Tightest and most stable spread claims refer to the lowest maximum spreads and the tightest average spreads on the Exness Pro account, for XAUUSD and USOIL based on data collected from 12-25 May 2025, when compared to the corresponding spreads across the commission-free accounts of other brokers.

2Executable spread claim/s refer to the maximum trading costs on XAUUSD, USDJPY, EURUSD, GBPUSD, and GBPJPY for the first two seconds following high-impact news. This comparison is made between the Exness Standard account and the commission-free accounts of several competitors – all excluding agent commission–from 1 January 2025 to 4 June 2025.

3 Delays and slippage may occur. No guarantee of execution speed or precision is provided. 4 At Exness, over 98% of withdrawals are processed automatically. Processing times may vary depending on the chosen payment method.

(Sponsored)

Source: TUKO.co.ke